A financial planner is a sort of advisor who works with you to develop a strategy to accomplish your long-term financial objectives. You can acquire a number of services from financial planners, like assistance with budget creation and determine how you might reduce your tax liability.

In this blog, we’ll discuss different aspects of a financial planner career and how to get there.

What do Financial Planners do?

Financial planners engage closely with clients to assist them in managing their finances and achieving their long-term financial objectives. An in-depth understanding of personal finance, taxes, budgeting, and investing are prerequisites for becoming a financial planner. They may have areas of expertise in tax planning, asset allocation, risk management, retirement planning, or estate planning. Many of them target a certain demographic when seeking clients, such as young professionals or retirees.

Financial planners provide clients with advice and support on a range of topics, including investing, retirement planning, paying for college or starting a new business while preserving money. Some financial planners give their clients assistance in developing an investment strategy but leave the precise choices up to the clients.

Some of the main duties of financial planners include:

- Helping clients gather information from bank statements, income tax returns, life and disability insurance records, pension plan information, and wills.

- Calculate the net worth of their clients.

- Identify personal and financial short-term and long-term goals and objectives of their clients.

Financial planners can work independently or together. They might operate from fully furnished workplaces or their homes. Many financial planners make the trip to client homes or places of business for meetings.

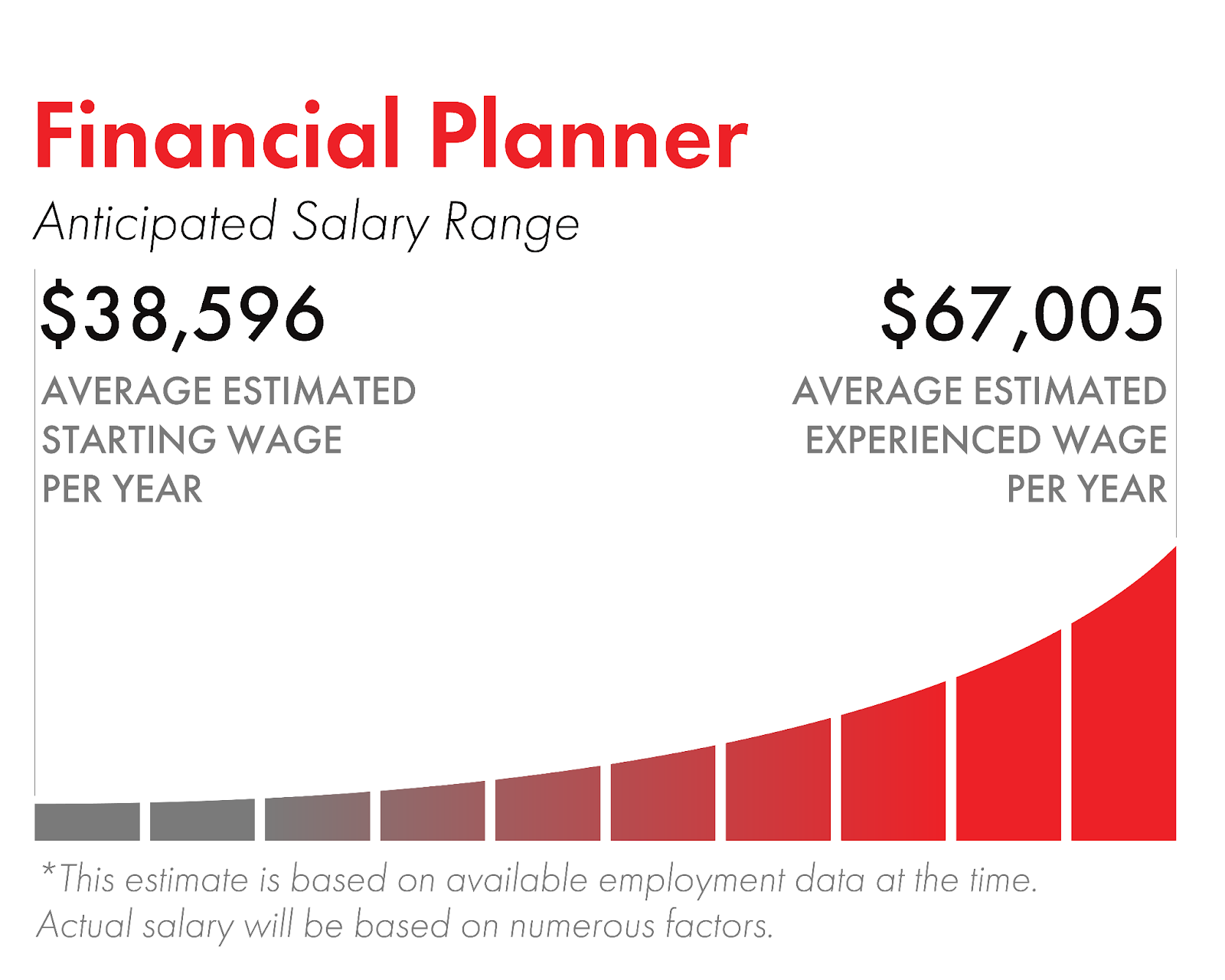

How Much do Financial Planners Make in Canada?

As per industry estimates, the average starting salary per annum for a financial planner is around $38, 596 and as you grow in experience, you can start making up to $67, 005 per annum. How much you can make as a financial planner also depends on the province that you work in, the organization, and the level of starting working in a firm. But as you gain experience and become senior in the field, you’ll start earning more.

What Skills Should Financial Planners Possess?

Financial advisors require multiple skills to be successful in today’s competitive world. They have to be proficient in both technical as well as soft skills. Financial planners need the following major skills:

- Confidentiality: Financial planners should be able to keep client information private.

- Confidence: They need to be confident in their field to convince and advise clients efficiently.

- Communication and listening abilities: Financial planners have to be good at communicating with clients so that they can gauge their financial needs properly and provide appropriate solutions.

- Business marketing and entrepreneurship skills: Many financial planners may work independently. They need good marketing skills to promote their business and drive it to the next level.

- Critical Thinking skills: They must have the capacity to comprehend complex financial papers, including financial accounts, tax laws, insurance policies, pension plans, and wills; to strike a balance between their clients’ needs and the scope of their services.

- Problem-solving: They should possess an openness to trying different techniques to solve problems.

Financial planners should also enjoy applying a rigorous approach to information collecting and analysis; developing new approaches to challenges; consulting with individuals; and directing the actions of others to achieve the desired financial goals.

Where Can Financial Planners Work?

Financial planning firms employ financial planners. Others opt for self-employment. Some financial planners have full-time jobs or work on a contract basis for bigger businesses and organizations like:

- Banks, trust firms, and other financial entities

- Businesses that trade stocks

- Insurance firms

- Law offices

- Accounting companies

- Mutual fund organizations

- Independent financial planning firms

- Online financial planning companies

Expert financial planners could focus on a certain area of financial planning, like wealth management or retirement planning. Additionally, they might advance into managerial or supervisory roles in bigger businesses or trade groups.

What are the Career Opportunities for Financial Planners?

Financial planning diploma graduates can enter the field through various career opportunities. These include roles of:

- Financial Planner

- Financial Planning Representative

- Associate Financial Planner

- Investment/Retirement/Tax Planner

Final Thoughts

Candidates who complete the Financial Planner Diploma program form a solid base of knowledge and abilities that helps them develop into self-assured financial planners. The curriculum of the program also covers getting ready for the Canadian Securities Course Exam.

Offered online from ABM College’s Toronto campus, you can complete this program in just 54 weeks.

If you are considering financial planner as a career, contact us now.

You can also read more industry-related articles here.

Graphics: freepik.com

About The Author

Private Career College

ABM College is a leader in career-focused education, committed to empowering students with industry-relevant skills. With expert instructors and practical training, ABM College delivers high-quality programs in health, business, technology, and more, ensuring graduates are prepared to meet workforce demands. Known for its supportive learning environment and a focus on real-world application, ABM College is a trusted educational partner helping students achieve professional success across Canada.